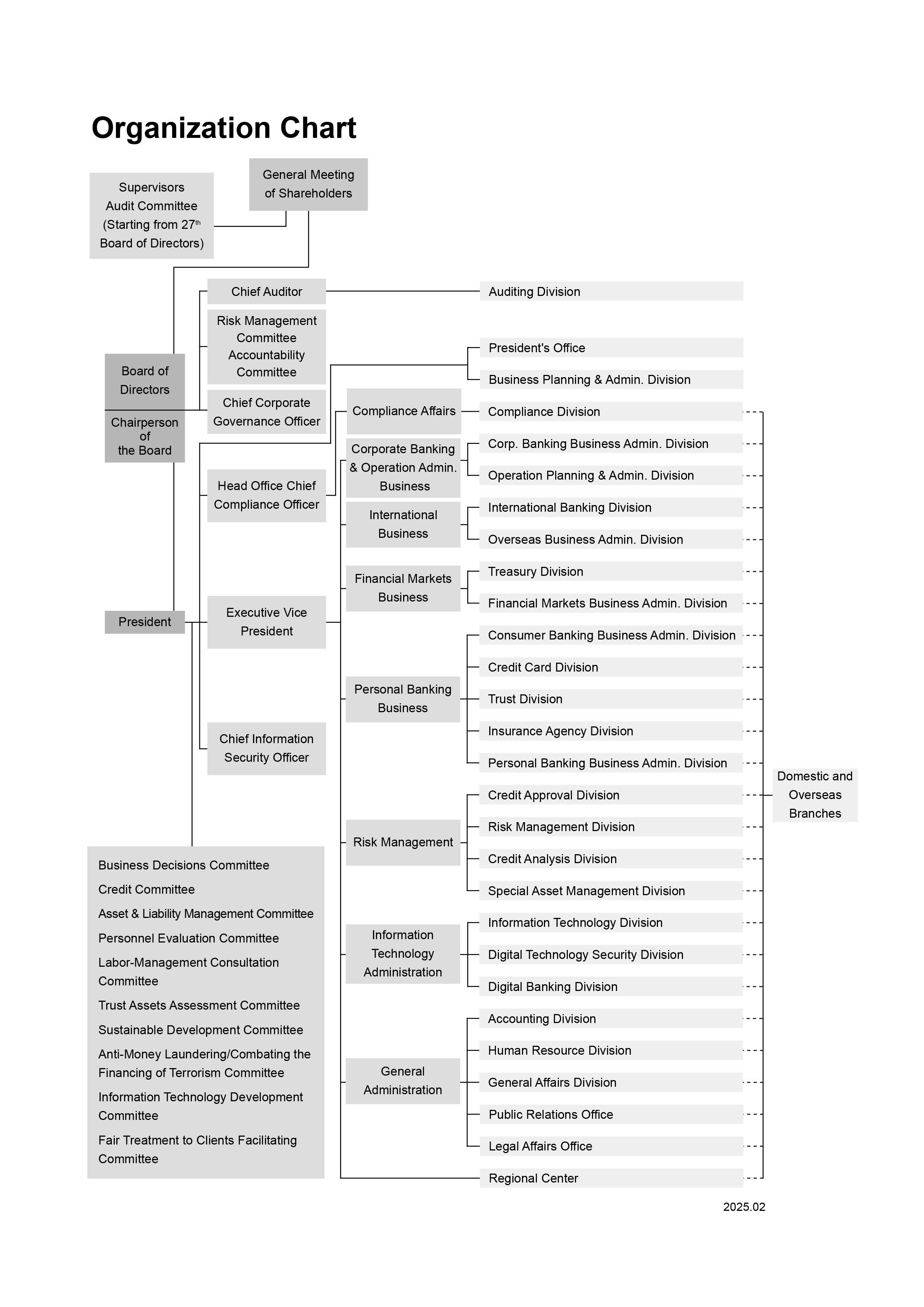

First Commercial Bank Co., Ltd.(hereinafter referred to as “the Bank”) establishes General Meeting of Shareholders, Board of Directors, Supervisors and Chairman of the Board. Starting from 27th Board of Directors, the Bank established Audit Committee to facilitate Board of Directors executing its supervisory duty and handling tasks entrusted by Company Act and Securities and Exchange Act. Under Board of Directors, the Bank sets Chief Auditor leading the Auditing Division, Risk Management Committee, Accountability Committee and Chief Corporate Governance Officer. The Bank sets a President, who leads the Executive Vice President, the Head Office Chief Compliance Officer, Chief Information Security Officer taken charged by Executive Vice President, and sets President's Office and the Business Planning & Admin. Division. The Business Decisions Committee, Credit Committee, Asset & Liability Management Committee, Personnel Evaluation Committee, Labor-Management Consultation Committee, Trust Assets Assessment Committee, Sustainable Development Committee, Anti-Money Laundering/Combating the Financing of Terrorism Committee, Information Technology Development Committee, Fair Treatment to Clients Facilitating Committee is subordinated to the President. The Head Office of the Bank includes 24 divisions, 3 offices and 6 centers which are grouped by the business and supervising the branches nationwide and overseas:

- Head Office Chief Compliance Officer is in charge of all the compliance affairs and supervises the Compliance Division.

- Corporate Banking & Operation Admin. Business includes Corp. Banking Business Admin. Division and Operation Planning & Admin. Division.

- International Business includes International Banking Division and Overseas Business Admin. Division.

- Financial Markets Business includes Treasury Division and Financial Markets Business Admin. Division.

- Personal Banking Business includes Consumer Banking Business Admin. Division, Credit Card Division, Trust Division, Insurance Agency Division and Personal Banking Business Admin. Division.

- Risk Management includes Credit Approval Division, Risk Management Division, Credit Analysis Division and Special Asset Management Division.

- Information Technology Administration includes Information Technology Division, Digital Technology Security Division and Digital Banking Division.

- General Administration includes Accounting Division, Human Resource Division, General Affairs Division, Public Relations Office and Legal Affairs Office.

The Bank sets Regional Centers.